unlocking your future:

a comprehensive guide to 401a plans and their benefits

In an ever-evolving financial landscape, planning for the future has never been more crucial. Enter the 401a plan—a powerful yet often-overlooked retirement savings tool that can unlock a wealth of opportunities for both employers and employees. Whether you’re looking to enhance your retirement nest egg or optimize your organization’s benefit offerings, understanding the nuances of these plans can be a game changer.

This comprehensive guide will delve into the various features and advantages of these plans, shedding light on how they can serve as a cornerstone in your financial strategy. From tax benefits to investment options, we’ll explore how you can navigate the intricacies of 401a plans to set yourself up for a more secure and prosperous future.

Get ready to unlock the potential of your retirement savings with insights that can make a real difference!

understanding 401a plans: an overview

Retirement planning can often seem like navigating a maze, but understanding the these plans can help you find your way. A 401a plan is a type of retirement savings account typically offered by governmental employers, educational institutions, and certain non-profit organizations.

This plan is designed to help employees save for retirement while offering various tax advantages.

The 401a plan stands out due to its flexibility and the role employers play in contributing to the fund. It is often tailored to meet the specific needs of the organization and its employees, making it a versatile option in the realm of retirement planning.

One of the distinguishing features of a 401a plan is that it is a defined contribution plan. This means that the contributions made into the plan are defined, but the benefits received at retirement depend on the performance of the investments.

Employers often contribute a significant portion of the funds, and in some cases, employee contributions are mandatory or voluntary. The combination of these contributions helps build a substantial retirement fund over time, providing employees with a sense of financial security as they approach their retirement years.

The 401a plan also allows for a variety of investment options, giving participants the opportunity to grow their savings through different financial instruments. These may include mutual funds, stocks, bonds, and other investment vehicles.

The flexibility in investment choices means that employees can tailor their retirement savings strategy to their individual risk tolerance and financial goals. Whether you are a conservative investor or someone who is more aggressive in your investment strategy, a 401a plan can be customized to meet your needs.

Key Features of 401a Plans

Several key features make these plans a valuable retirement saving tool. One of the most notable features is the employer contribution.

Employers are typically required to contribute to the plan, which can be in the form of matching contributions or a fixed percentage of the employee’s salary.

This employer contribution can significantly enhance the growth of the retirement fund, providing an additional layer of financial security.

Another important feature of 401a plans is the vesting schedule. The vesting schedule determines when employees have ownership of the employer-contributed funds.

This schedule can vary from immediate vesting, where employees own the contributions right away, to a graded schedule, where ownership is earned over a period of years.

The vesting schedule is an essential component as it can influence an employee’s decision to stay with an employer, thus impacting retention rates.

Additionally, 401a plans offer a range of investment options. Participants can choose from a variety of investment vehicles, including mutual funds, stocks, bonds, and other securities.

This diversity in investment choices allows for a customized approach to retirement savings, enabling employees to create a portfolio that aligns with their risk tolerance and financial goals.

The ability to diversify investments within a 401a plan can help mitigate risk and potentially enhance returns over the long term.

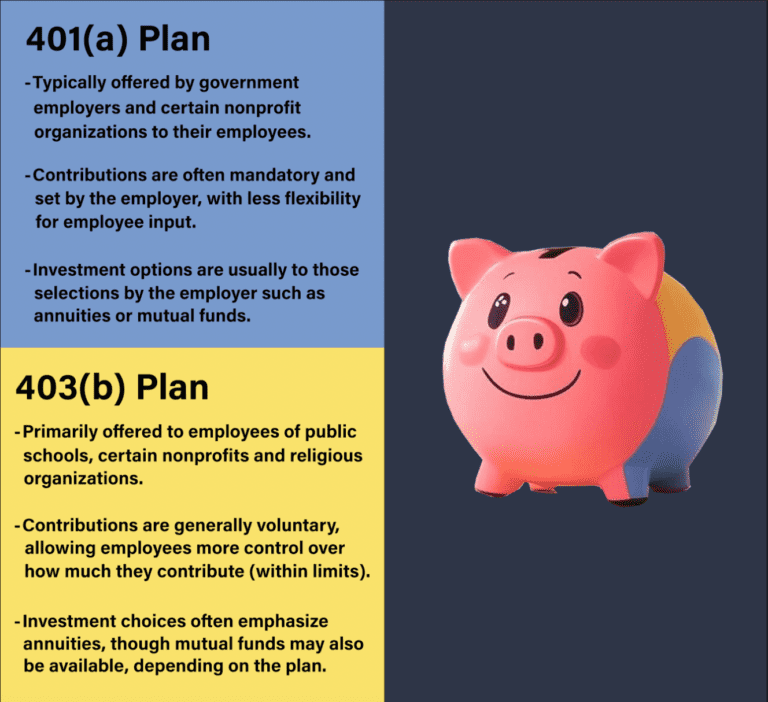

Differences Between 401a Plans and Other Retirement Accounts

While 401a plans share some similarities with other retirement accounts, such as 401k and 403b plans, there are distinct differences that set them apart. One of the primary differences is the type of employers that offer these plans.

401a plans are generally provided by government entities, educational institutions, and certain non-profit organizations. In contrast, 401k plans are typically offered by private-sector employers, and 403b plans are commonly available to employees of non-profit organizations and public school systems.

Another significant difference lies in the contribution structure. In a 401a plan, employer contributions are often a key component and can be either mandatory or voluntary.

Employee contributions may also be required or optional, depending on the plan’s design. This contrasts with 401k and 403b plans, where employee contributions are usually the primary source of funding, and employer contributions are often in the form of matching contributions.

Additionally, the investment choices available in 401a plans can differ from those in other retirement accounts. While 401k and 403b plans typically offer a broad range of mutual funds and other investment options, 401a plans may provide a more curated selection of investments.

This curated approach can be beneficial as it encourages employees to make informed investment decisions based on their financial goals and risk tolerance.

Understanding these differences is crucial for making informed decisions about retirement savings and choosing the plan that best aligns with your needs.

Benefits of Contributing to a 401a Plan

Contributing to a 401a plan offers several advantages that can significantly enhance your financial well-being in retirement. One of the primary benefits is the potential for employer contributions.

Many employers contribute a fixed percentage of an employee’s salary to the 401a plan, which can substantially increase the amount of money saved for retirement. This employer contribution is essentially “free money” that can help your investments grow more quickly over time.

Another key benefit is the tax advantages associated with 401a plans. Contributions made to the plan are typically made on a pre-tax basis, which means they reduce your taxable income for the year. This can lower your overall tax liability, allowing you to save more money for retirement.

Additionally, the investments within the 401a plan grow tax-deferred, meaning you won’t pay taxes on the gains until you withdraw the funds during retirement. This tax-deferred growth can result in a larger retirement nest egg over time.

Furthermore, 401a plans offer a range of investment options that can help you tailor your retirement savings strategy to your individual needs. Whether you prefer low-risk investments like bonds or want to take a more aggressive approach with stocks, a 401a plan can accommodate your preferences.

The ability to diversify your investments within the plan can help mitigate risk and potentially increase your returns, providing a more secure financial future.

Eligibility Requirements

Eligibility for 401a plans is typically determined by the employer and can vary based on the organization’s policies. Generally, these plans are offered to employees of government entities, educational institutions, and certain non-profit organizations.

This includes public school teachers, university staff, government employees, and employees of non-profit organizations that qualify under specific IRS guidelines. The employer sets the criteria for who can participate in the plan, which may include full-time, part-time, and in some cases, temporary employees.

In many cases, eligibility is also tied to the length of service or employment status. For example, an employer may require an employee to complete a certain number of months or years of service before becoming eligible to participate in the 401a plan.

This service requirement helps ensure that employees are committed to the organization before they receive the benefits of the retirement plan. Some employers may also have age requirements, such as being at least 21 years old, before an employee can join the plan.

Additionally, the terms of the 401a plan, including contribution rates and vesting schedules, are often outlined in the plan documents provided by the employer. It is essential for employees to review these documents to understand the specific requirements and benefits associated with their 401a plan.

By understanding the eligibility requirements and plan details, employees can make informed decisions about their retirement savings and take full advantage of the benefits offered by their employer.

How to Set Up a 401a Plan

Setting up a 401a plan involves several steps and requires coordination between the employer and the plan administrator. The first step is for the employer to determine the specific goals and objectives of the retirement plan.

This includes deciding on the contribution structure, vesting schedule, and the range of investment options that will be offered to employees. The employer must also ensure that the plan complies with IRS regulations and other applicable laws.

Once the plan design is finalized, the employer typically works with a plan administrator or financial institution to set up the 401a plan.

The plan administrator is responsible for managing the day-to-day operations of the plan, including processing contributions, managing accounts, and providing investment options.

The employer and plan administrator will also collaborate to create plan documents that outline the terms and conditions of the 401a plan. These documents are essential for ensuring that the plan operates in compliance with regulatory requirements.

After the plan is set up, the employer must communicate the details of the 401a plan to eligible employees.

This communication usually involves providing educational materials, holding informational meetings, and offering one-on-one consultations to help employees understand the benefits and features of the plan.

Employees will need to complete enrollment forms and designate their contribution rates and investment choices. Once enrolled, employees can begin making contributions to their 401a plan and take advantage of the retirement savings opportunities it offers.

Investment Options Available

One of the key advantages of a 401a plan is the variety of investment options available to participants. These options allow employees to tailor their investment strategy to their individual financial goals and risk tolerance.

Common investment options within a 401a plan include mutual funds, which pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, and other securities. Mutual funds offer the benefit of diversification, which can help reduce risk and enhance returns over the long term.

In addition to mutual funds, 401a plans may offer other types of investments, such as individual stocks and bonds. Investing in individual stocks allows participants to take a more hands-on approach to their retirement savings, potentially reaping higher returns if the selected stocks perform well.

Bonds, on the other hand, are generally considered lower-risk investments and can provide a steady stream of income through interest payments. Including a mix of stocks and bonds in your 401a plan can help balance risk and reward, providing a more stable investment portfolio.

Some 401a plans also offer target-date funds, which are designed to automatically adjust the asset allocation based on the participant’s expected retirement date.

These funds start with a more aggressive investment strategy when the participant is younger and gradually shift to a more conservative approach as retirement approaches.

Target-date funds can be an excellent option for employees who prefer a more hands-off approach to investing, as they provide a built-in investment strategy that adjusts over time to align with the participant’s retirement goals.

Tax Implications of 401a Plans

One of the most significant advantages of a 401a plan is the favorable tax treatment it offers. Contributions to a 401a plan are typically made on a pre-tax basis, which reduces your taxable income for the year.

This means that you pay less in federal income taxes, allowing you to save more money for retirement. For example, if you earn $50,000 a year and contribute $5,000 to your 401a plan, your taxable income would be reduced to $45,000, potentially lowering your tax liability.

In addition to the tax benefits on contributions, the investments within the 401a plan grow tax-deferred. This means that you do not have to pay taxes on the gains, dividends, or interest earned within the plan until you withdraw the funds during retirement.

The tax-deferred growth can result in a larger retirement nest egg, as the money that would have gone to taxes can instead be reinvested and compounded over time.

When you eventually withdraw the funds, they will be taxed as ordinary income, but this is often at a lower rate if you are in a lower tax bracket during retirement.

It is important to note that there are specific rules and regulations regarding withdrawals from a 401a plan. Generally, withdrawals made before the age of 59½ are subject to a 10% early withdrawal penalty in addition to ordinary income taxes.

However, there are exceptions to this rule, such as withdrawals for certain financial hardships or if you separate from service after reaching age 55.

Understanding the tax implications and withdrawal rules of your 401a plan can help you make informed decisions about your retirement savings and avoid unnecessary penalties.

Common Misconceptions About 401a Plans

Despite the numerous benefits of 401a plans, there are several common misconceptions that can deter individuals from taking full advantage of these retirement savings vehicles. One prevalent misconception is that 401a plans are only for public sector employees.

While it is true that these plans are commonly offered by government entities and educational institutions, they are also available to employees of certain non-profit organizations.

Understanding the eligibility criteria and the types of employers that offer 401a plans can help dispel this myth and encourage more individuals to explore their options.

Another misconception is that 401a plans do not offer the same level of investment flexibility as other retirement accounts. While it is true that the investment options in a 401a plan may be more curated, this does not mean they are less effective.

In fact, the investment choices within a 401a plan are often selected to provide a balanced and diversified portfolio that can help maximize returns while minimizing risk.

By offering a range of mutual funds, stocks, bonds, and target-date funds, 401a plans can cater to a variety of investment strategies and risk tolerances.

A final misconception is that the tax benefits of 401a plans are not as advantageous as those of other retirement accounts. On the contrary, 401a plans offer significant tax advantages, including pre-tax contributions and tax-deferred growth.

These benefits can result in substantial tax savings over time, allowing participants to accumulate a larger retirement nest egg.

By understanding the true benefits and features of 401a plans, individuals can make more informed decisions about their retirement savings and take full advantage of the opportunities these plans offer.

Conclusion: Making the Most of Your Plan

In the complex world of retirement planning, a 401a plan stands out as a versatile and powerful tool for securing your financial future.

With its combination of employer contributions, tax advantages, and diverse investment options, a 401a plan can significantly enhance your retirement savings strategy.

Whether you are just starting your career or are well on your way to retirement, understanding the nuances of 401a plans can help you make informed decisions and maximize the benefits available to you.

Taking the time to understand the key features, eligibility requirements, and investment options of your 401a plan is essential for making the most of this valuable retirement savings vehicle.

By contributing regularly and taking advantage of employer contributions, you can build a substantial retirement fund that will provide financial security in your later years.

Additionally, the tax advantages of pre-tax contributions and tax-deferred growth can result in significant savings over time, further enhancing your retirement nest egg.

Ultimately, a 401a plan can serve as a cornerstone of your financial strategy, providing a solid foundation for a secure and prosperous retirement.

By dispelling common misconceptions and understanding the true benefits of a 401a plan, you can make informed decisions that will help you achieve your retirement goals.

Unlock the potential of your retirement savings with a 401a plan and set yourself up for a brighter financial future.